As noted by u/rhythm_of_eth on r/ethereum:

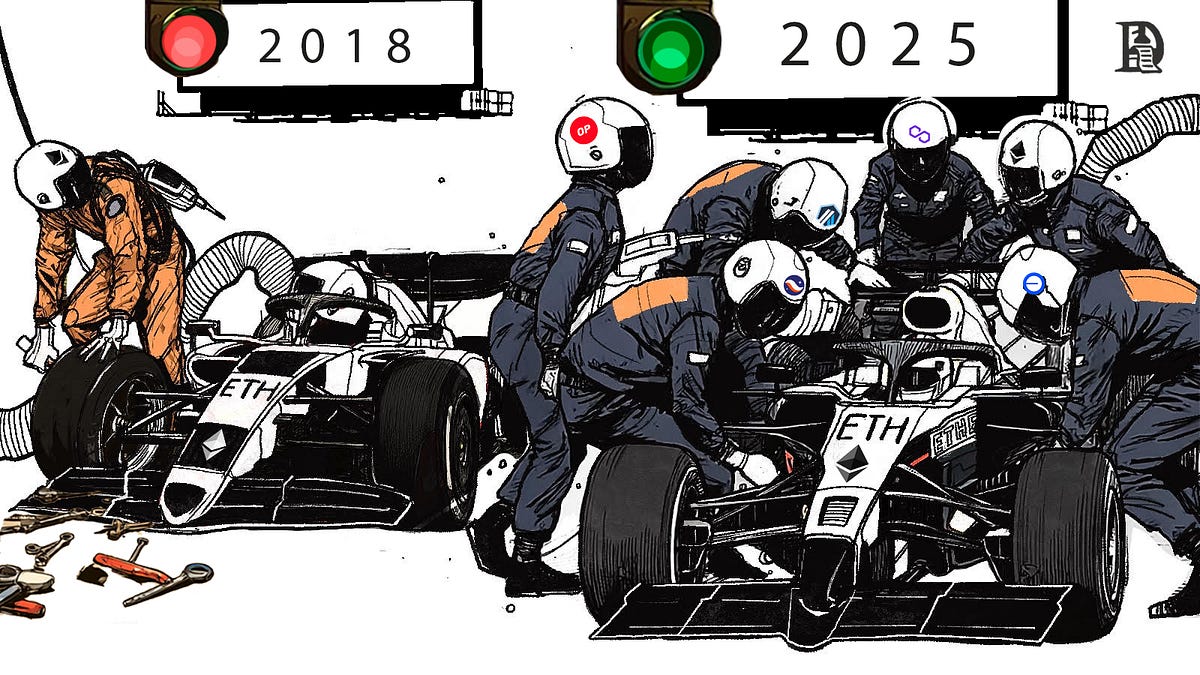

Article on how Ethereum is capturing alt-L1s masterfully while working towards offering options for sustainable and reliable L2 businesses and making this acreative to L1 network effects and deflation mechanisms in the long run.

Specially relevant: the stats about L2 profit margins, and how widely they vary when blob limits are low, then tend towards less volatile when there’s a wider range for price discovery.

Remember, we said that Ethereum is to rollups what cloud service providers are to software businesses. What happened after the cost of using cloud services dropped? The demand grew, and so did the revenues of cloud providers. AWS is the cleanest example here. It continued to cut prices for customers and still grew like a utility.

Yeah, cash tokens are kinda interesting. BCH is how to Bitcoin should have been.

Yes for sure, there already is a DEX dApp for CashTokens similar Uniswap on ETH.

https://app.cauldron.quest/tokens

Thats sick. What are the fees like? (with cashtokens)

The fees are same as a regular transaction, so super low, less than 1 cent.

I am curious on how the miners will be paid once the subsidies are complete since the transaction fees are so low. I’m learning more about BCH and I want to see if it’s worth me providing hashrate for the network.

The goal is still the original Bitcoin plan. Build the best usable blockchain and collect fees from transactions to sustain miners after the block rewards dwindle. We have been delayed pretty badly by the BTC hijacking but there is still time.

This is a great resource to answer many of your questions about BCH.

https://bitcoincashpodcast.com/faqs

There wasn’t a Hijacking though, there was a split and both became two different currencies. But it seems like it has the same issues as Bitcoin as well.