As noted by u/rhythm_of_eth on r/ethereum:

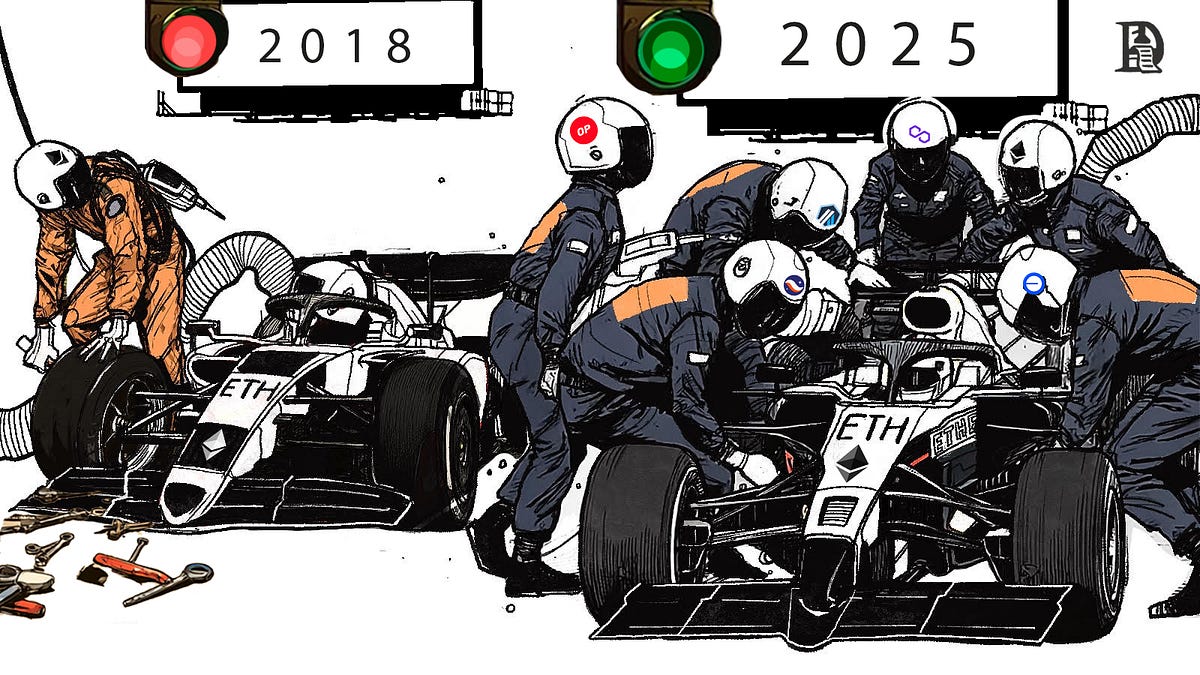

Article on how Ethereum is capturing alt-L1s masterfully while working towards offering options for sustainable and reliable L2 businesses and making this acreative to L1 network effects and deflation mechanisms in the long run.

Specially relevant: the stats about L2 profit margins, and how widely they vary when blob limits are low, then tend towards less volatile when there’s a wider range for price discovery.

Remember, we said that Ethereum is to rollups what cloud service providers are to software businesses. What happened after the cost of using cloud services dropped? The demand grew, and so did the revenues of cloud providers. AWS is the cleanest example here. It continued to cut prices for customers and still grew like a utility.

BCH and BTC are two different currencies with two different ways to handling payments. I use BTC in my daily life and have no issue using it as a currency. Even without the Lightning Network I am still able to use it as my daily currency since merchants in my area are okay with 1 conf transactions. One did not hijack the other, it was just a disagreement of two different kind if views that blossomed two different currencies. Also Bankers didn’t pump Bitcoin, it was just open hype during the pandemic and it followed suit once more people understood how the concept of Bitcoin worked. It could have happened to BCH if it was in the same spotlight.

That is not at all how it went down. Watch the video I linked if you want to know what actually happened. It contains evidence of the events that transpired not just imagination.